How to generate VAT invoices in Shopify?

With the latest Shopify Editions, released toward the end of 2024, Shopify introduced a greatly welcomed feature: the ability to generate VAT invoices for customers in the EU and UK (excluding orders shipping to Portugal).

While the customization options for the invoice template remain very limited, this update demonstrates Shopify’s commitment to addressing VAT invoice requirements in the EU.

Let’s explore how to set up VAT invoice generation and assess whether it meets the necessary compliance requirements for EU and UK countries.

How to activate VAT invoice generation in Shopify?

To start generating VAT invoices for your customers, you need to enter a valid VAT ID in the Shopify admin. Follow these steps to set it up (you can skip this if you’ve already completed it):

- From your Shopify admin, go to Settings -> Taxes and duties.

- Select European Union or United Kingdom.

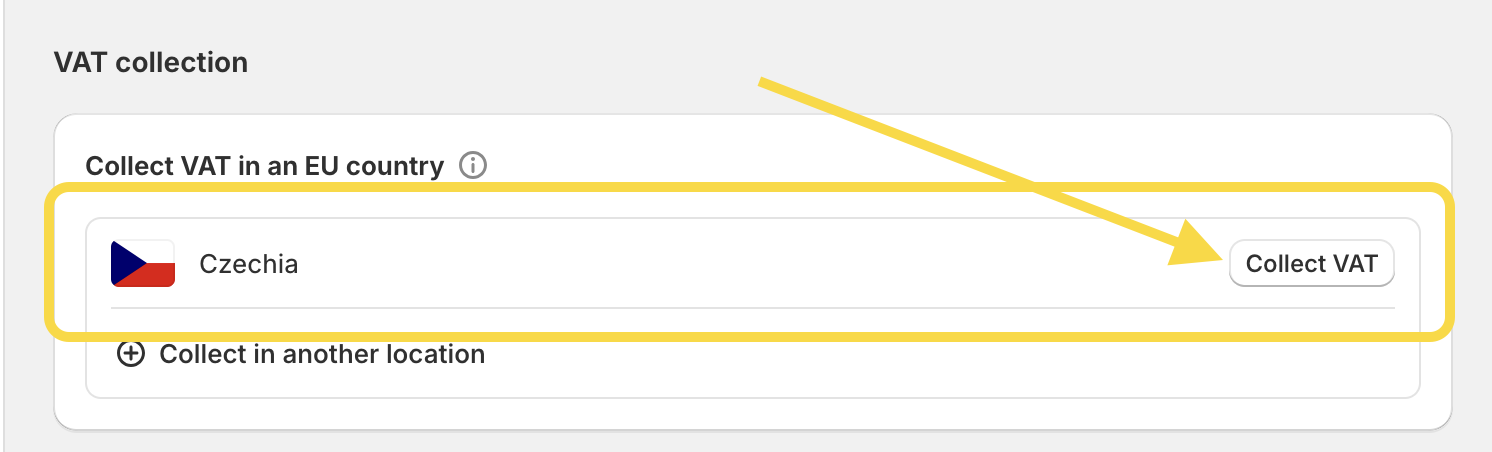

-

In the VAT collection section, click the button Collect VAT next to your country (this is automatically added based on your business address and other details you’ve provided).

- Enter your VAT ID and click Collect VAT

Note: If you’re selling to other EU countries, you may need to provide an additional VAT ID. This depends on whether you collect VAT through a One Stop Shop (OSS) registration, use a separate VAT registration for each country, or use your home country registration only. The latter applies only to micro-businesses based in a single EU country with annual sales of less than €10,000 to other EU countries.

Next, you need to activate the VAT invoices feature in your Shopify admin. Follow these steps:

- From your Shopify admin, go to Settings -> Taxes and duties.

- Select European Union or United Kingdom.

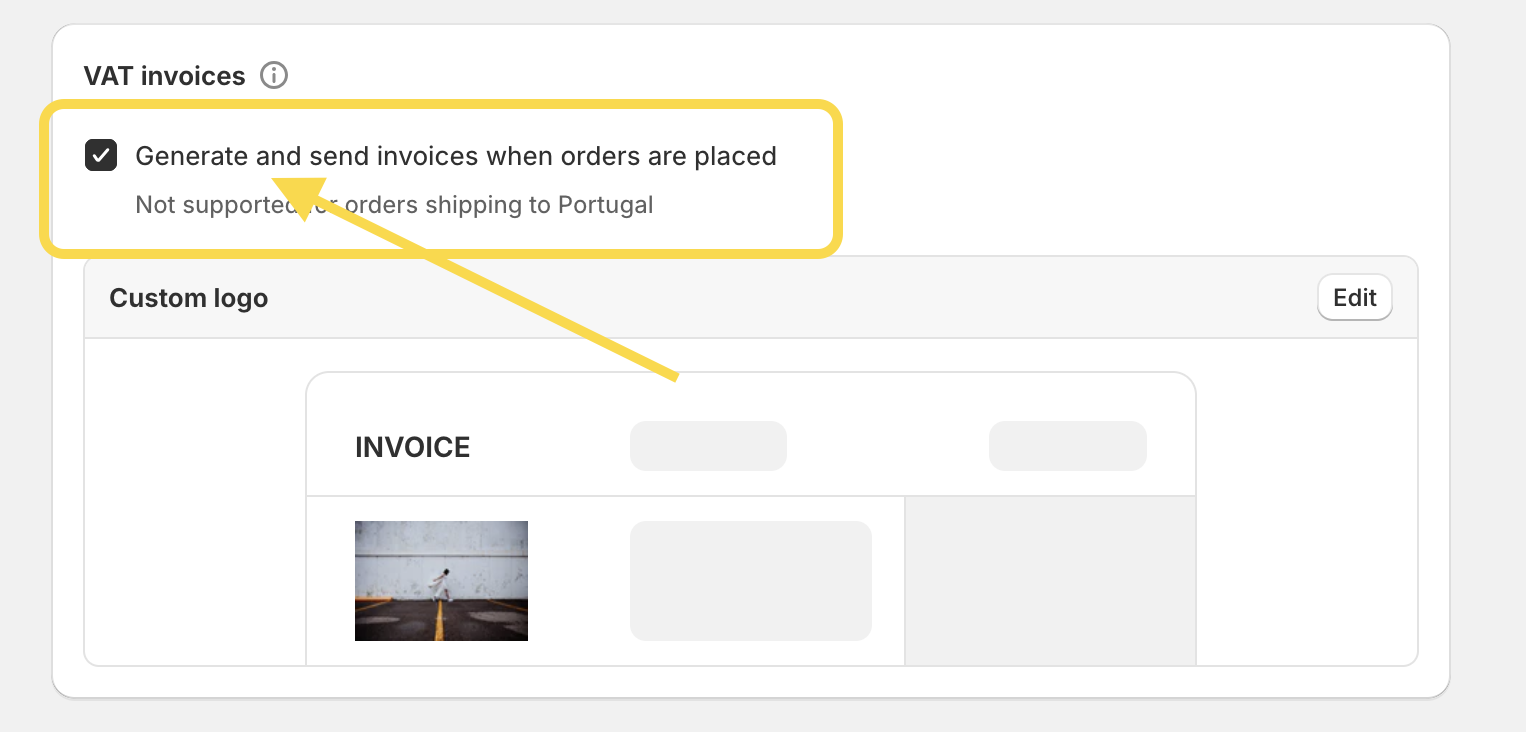

- In the VAT Invoices section, check the option Generate and send invoices when orders are placed.

Is it possible to customizate the invoice layout?

Unfortunately, no. The only available customization is the option to add your logo. At this time, it’s not possible to include additional invoice lines, notes, your company stamp, or else.

Is it possible to change the invoice content and add translations?

Unfortunately, no. You cannot edit any invoice lines or add custom translations. The translations are generated automatically, and there is currently no way to modify them or include your own lines or notes.

Can you add a link to download the invoice in the order confirmation email?

Currently, it’s not possible to add a direct link to download the invoice. However, you can modify the order confirmation email to include a direct link to the order detail in the customer’s account. This link (the same one used for the View your order button in the order confirmation email) will lead to the order details page, where they can download the invoice in PDF format.

To implement this, simply add a short sentence wherever it fits best, such as:: You can download the invoice here, to clearly inform customers about the option to download their invoice.

Here’s an example of the code snippet you can use (you may need to adjust the styling to match your current order confirmation layout):

<p>You can download the invoice <a href="{{order_status_url}}" target="_blank">here</a>.</p>

Are VAT invoices automatically sent to customers?

Unfortunately, no. While the invoice is automatically generated when an order is placed, it is neither attached to the order confirmation email nor sent as a standalone email automatically. You can only include the link to the order status page, as mentioned in the previous paragraph.

If you wish to send the invoice as a PDF attachment to your customers, you can do this manually as follows:

- From your Shopify admin, go to Orders.

- Open the order for which you want to send a VAT invoice.

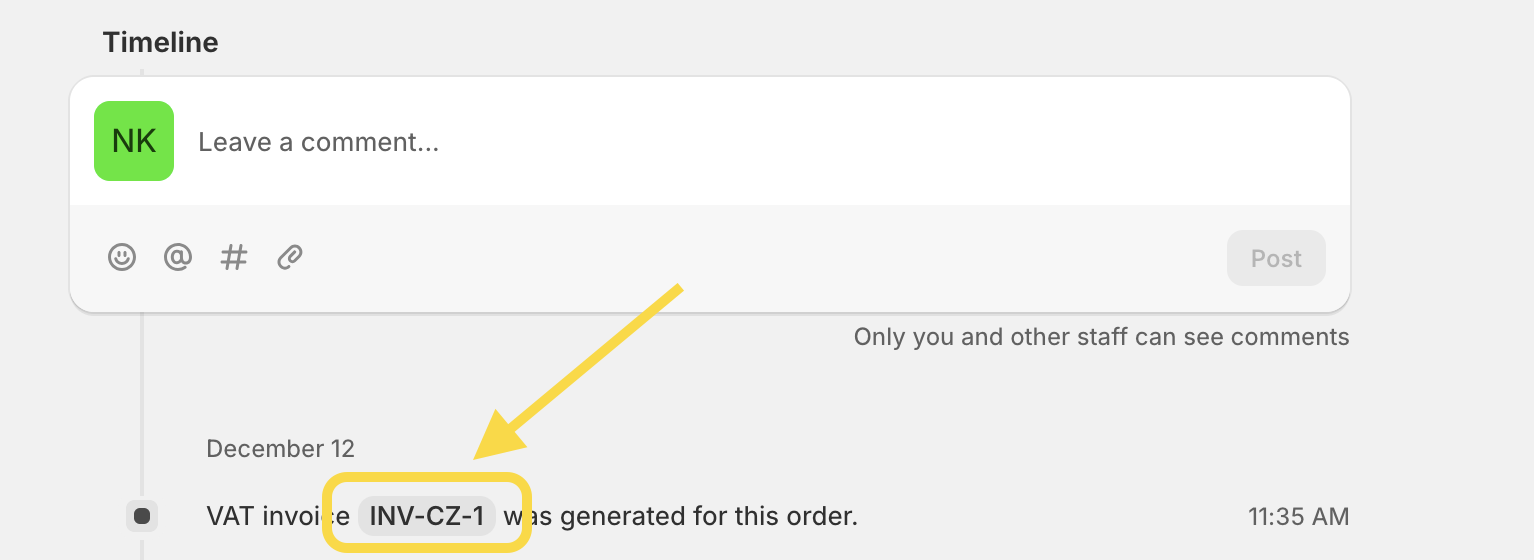

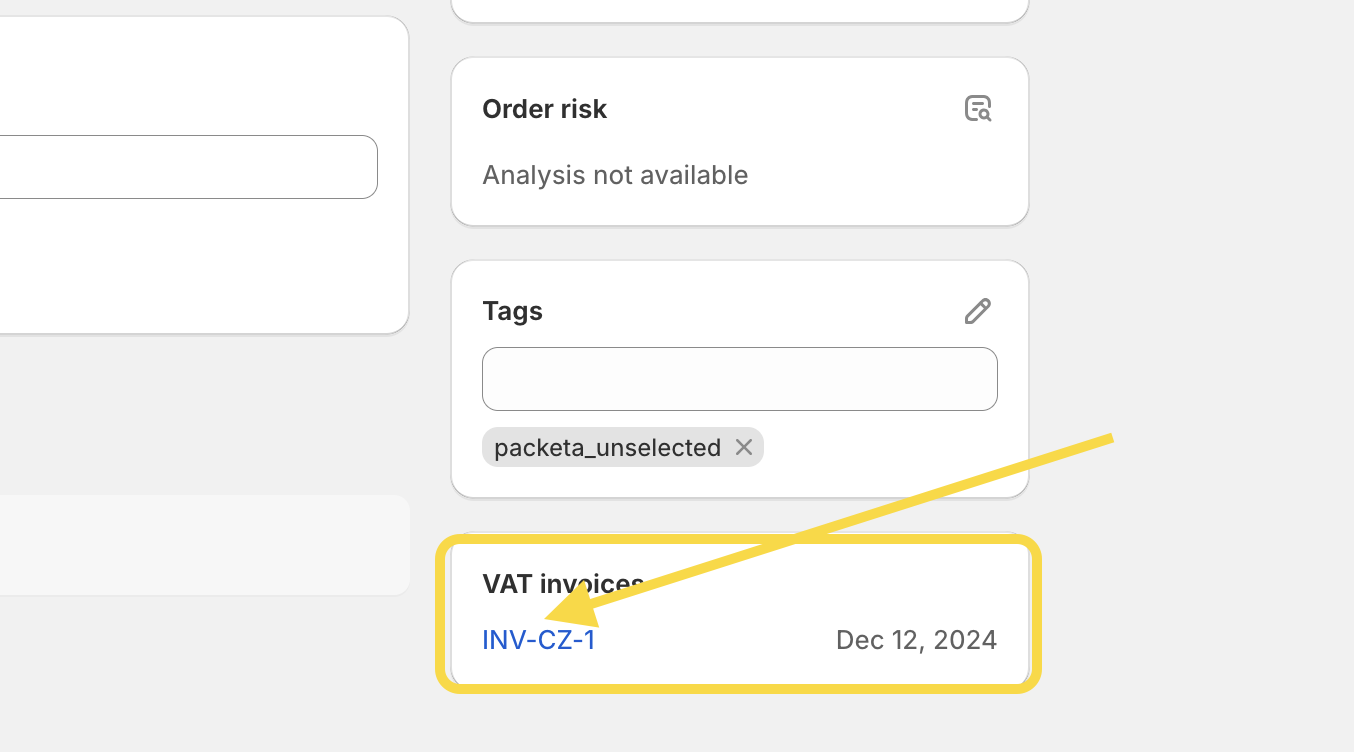

-

In the VAT invoice or Timeline section, click on the generated VAT invoice.

- The invoice opens in a PDF preview, allowing you to download the VAT invoice and manually email it to the customer.

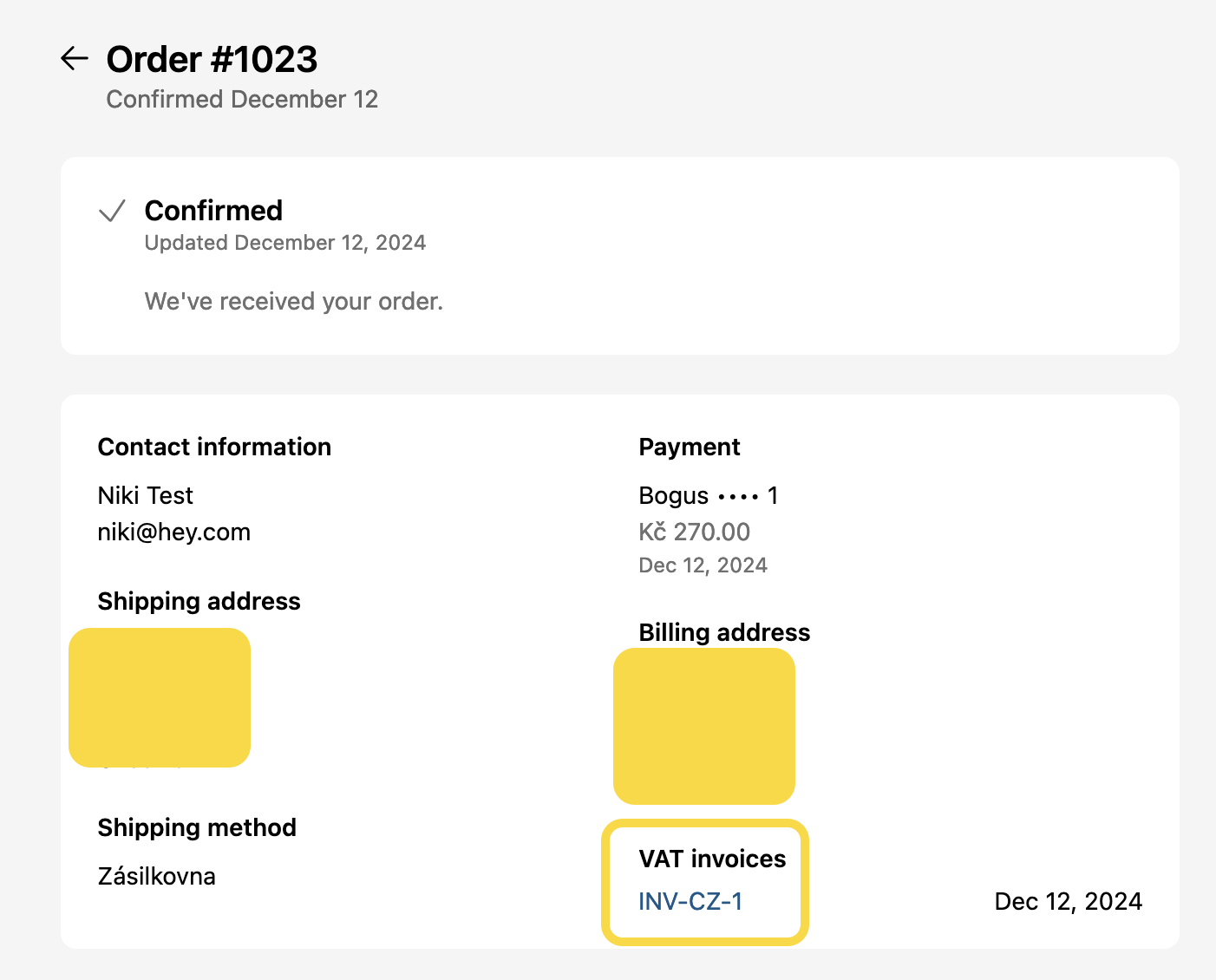

Can customers access the invoices anytime?

Yes, they can. Once an order is created, the invoice is accessible through the customer account. However, the store must use the updated customer accounts (also known as new customer accounts) for this functionality to be available.

Is the invoice template available for code edits?

Unfortunately, not at this time.

Is the VAT invoice feature free of charge?

The VAT invoice feature is part of Shopify Tax and can only be used when Shopify Tax is activated. Shopify Tax is free of charge until you exceed the threshold of €100,000 EUR (applicable to EU countries) in global sales. Once this threshold is exceeded, transaction fees may apply based on your pricing plan.

For example:

- For Shopify Plus stores, the transaction fee is 0.15%, capped at €0.99 EUR per transaction for EU countries.

- For non-Plus stores, the fee is 0.25%, also capped at €0.99 EUR per transaction.

There is a maximum annual fee of €5,000 EUR (all pricing plans).

For more details on pricing and thresholds, please refer to the Shopify official documentation.

Are the generated invoices sufficient for accounting purposes?

This largely depends on the country and its local accounting requirements. For example, in the Czech Republic, there are some shortcomings that a local accounting firm might critique. However, if your business is just starting out and you prefer to avoid setting up a more complex accounting or invoicing system, Shopify’s VAT invoices might serve as a temporary, limited solution.

That said, due to the lack of customization options, control over content, and the absence of automation, we recommend using a paid app such as Order Printer Pro or integrating directly with your accounting system for a more robust solution.

Although the VAT invoice feature has some limitations, Shopify often rolls out features early, even if they’re not fully complete or configurable. Based on this trend, it’s likely that Shopify will introduce customization options and additional features for VAT invoices in the future to better meet the needs of European and UK merchants. Stay tuned!